Welcome to Gabriel & Partners

Chartered Accountants

Caringbah, Sydney NSW

We are Gabriel & Partners

Chartered Accountants in Caringbah, Sydney NSW

Gabriel & Partners is a specialist firm of Chartered Accountants located at Caringbah in Sydney's Sutherland Shire, where our team has been helping businesses and individuals since 1987. With a good number of experienced staff, we are large enough to offer specialised and professional help, but small enough to offer competitive rates and personal service.

The Gabriel & Partners Team

Accounting Firm Established in 1987

Gabriel & Partners was established on 1st April 1987, with the two founding partners, Chris Gabriel and Dennis Furey recognising the need for a firm providing personalised and pro-active services to business and individual clients.

Experience with Helping Many Industries and Individuals, here and abroad

From the outset, Gabriel & Partners has been a major accounting practice and in the Sutherland Shire and has maintained a large and varied client base including:

- Professionals such as solicitors, doctors, dentists and architects;

- Business both large and small, including building, construction, manufacturing, real estate, wholesale, retail and primary production, and

- Investors.

Though the firm has chosen to remain suburban based, we are extensively engaged by clients throughout the Sydney metropolitan area, intrastate, interstate and overseas.

Independent with no Hidden Relationships

In the current environment where other firms can be controlled by third parties such as large financial planning organisations and listed companies, Gabriel & Partners is 100% owned and operated by its partners, and clients can be assured of receiving independent advice from us.

Aim to be Pro-Active and Accessible

Our aim is to provide a service which takes a pro-active role in our clients' affairs to ensure the greatest benefit may be made of business ventures and investment decisions as well as ensuring that correct and appropriate tax planning methods are implemented.

We also maintain a close relationship with our clients, and all partners and staff of the firm make themselves readily accessible to clients - there will always be someone at Gabriel & Partners to take your call.

Our Services

-

Business Accounting

We'll take care of your accounting and taxation requirements while you concentrate on running your business

-

Personal Accounting

From tax returns to investment properties and negative gearing, we can help individuals and families

-

Bookkeeping

Every successful business is built around a well-managed set of books and financial records, and we can help with yours

-

Cloud Accounting

We can assist you adopt and use a cloud accounting solution that works for you, saving you time and money

-

Auditing

Whether you're requested by the government or you just want to see your current financial status, we've got your auditing needs covered

-

Business Advisory

Our main aim is to help our clients grow, strengthen and develop their businesses by advising on strategic short and long term goals

-

Business Structures

Choosing or changing your business structure is an important decision, and we can advise on the best structure for your needs

-

Business Start-Ups

Ensure your new start-up venture hits the ground running with the correct structure and strategic goals in place

-

Trusts

We can help you establish trusts for personal or business use and assist with the administrative tasks

-

SMSF Administration

With constantly changing legislation, ensure your SMSF is always compliant with our SMSF administration service

Our Team

Christopher Gabriel

Partner

Victor Jarmusz

Partner

Vicky Tzirtzilakis

Associate

Marion Gregorace

Senior Manager

Ian Linton

Senior Manager

Melissa Johnston

Client Manager

Brittani Battle

Client Manager

Soraya Taleb

Client Manager

Kathryn Vial

Client Manager

Caterina Chave

Client Manager

Amanda Gosby

Administration

Latest Accounting News

ATO reveals common rental property errors from data-matching program

Recent results from the data-matching program identified issues around the reporting of rental income and...

New SMSF expense rules: what you need to know

If you manage a self-managed superannuation fund (SMSF), recent changes to tax rules for certain fund expenses...

Government releases details on luxury car tax changes

The draft legislation aims to modernise the luxury car tax by tightening the definition of a fuel-efficient...

Treasurer unveils design details for payday super

The government has released further details about the design of its payday super policy including an updated...

6 steps to create a mentally healthy and vibrant workplace

It’s estimated we spend a third of our life at work. It may even be more if you run your own small business...

What are the government’s intentions with negative gearing?

Both the Treasurer and the Prime Minister have confirmed that Treasury is exploring changes to the contentious...

Small business decries ‘unfair’ payday super changes

The seven-day payment window and closure of the ATO’s clearing house are expected to disproportionately...

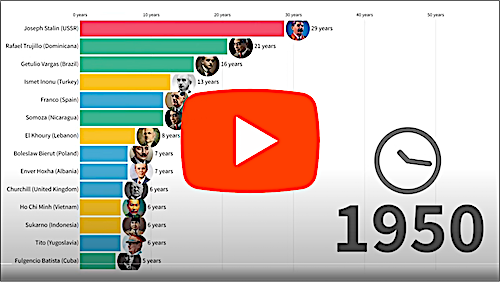

The Leaders Who Refused to Step Down 1939 - 2024

Check out the The Leaders Who Refused to Step Down 1939 ...

Time for a superannuation check-up?

The new financial year has begun, and with it have come some important changes to superannuation from 1 July...

Tools & Resources

Contact Us

Get in Touch

Gabriel & Partners welcome your enquiry. To book an appointment or simply ask us a question, fill in your details and we'll be in touch soon!

- accountants@gabriels.com.au

- 84 Cawarra Road, Caringbah NSW 2229

- PO Box 2070, Taren Point BC NSW 2229

- (02) 9526 0999

- (02) 9531 6527

- 8:30AM to 5:00PM