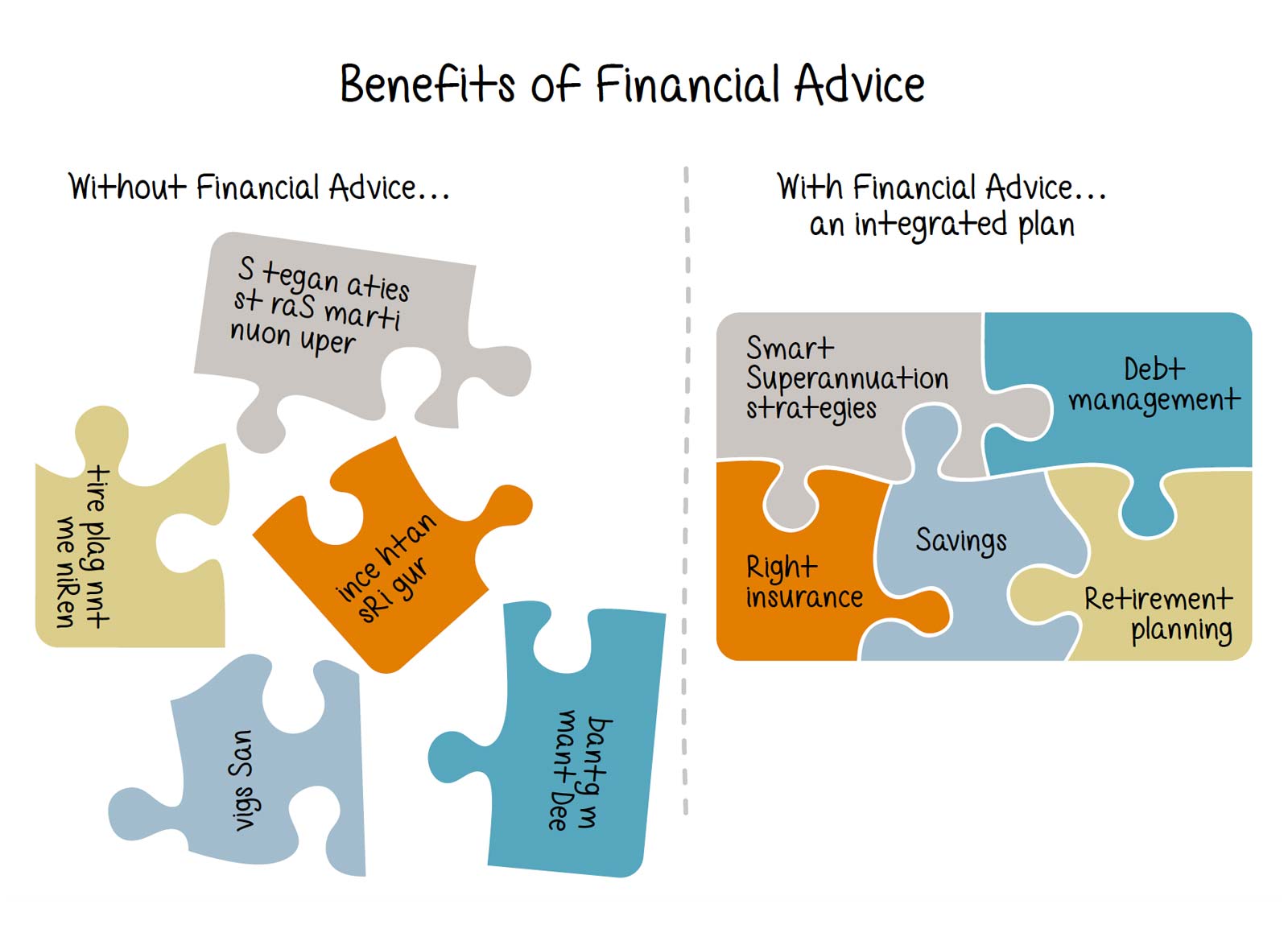

Financial planning is a life-long journey and we are with you every step of the way. CBC Financial Advisers can help you get a clear understanding of your finances and goals to work out how much you need, understand the choices available to you, set up appropriate strategies to suit your individual circumstances, and create a personalised plan to help you achieve your goals.

At A Glance...

Our Services

Our services include:

- Financial planning

- Wealth creation

- Wealth protection (insurance)

- Superannuation

- Gearing

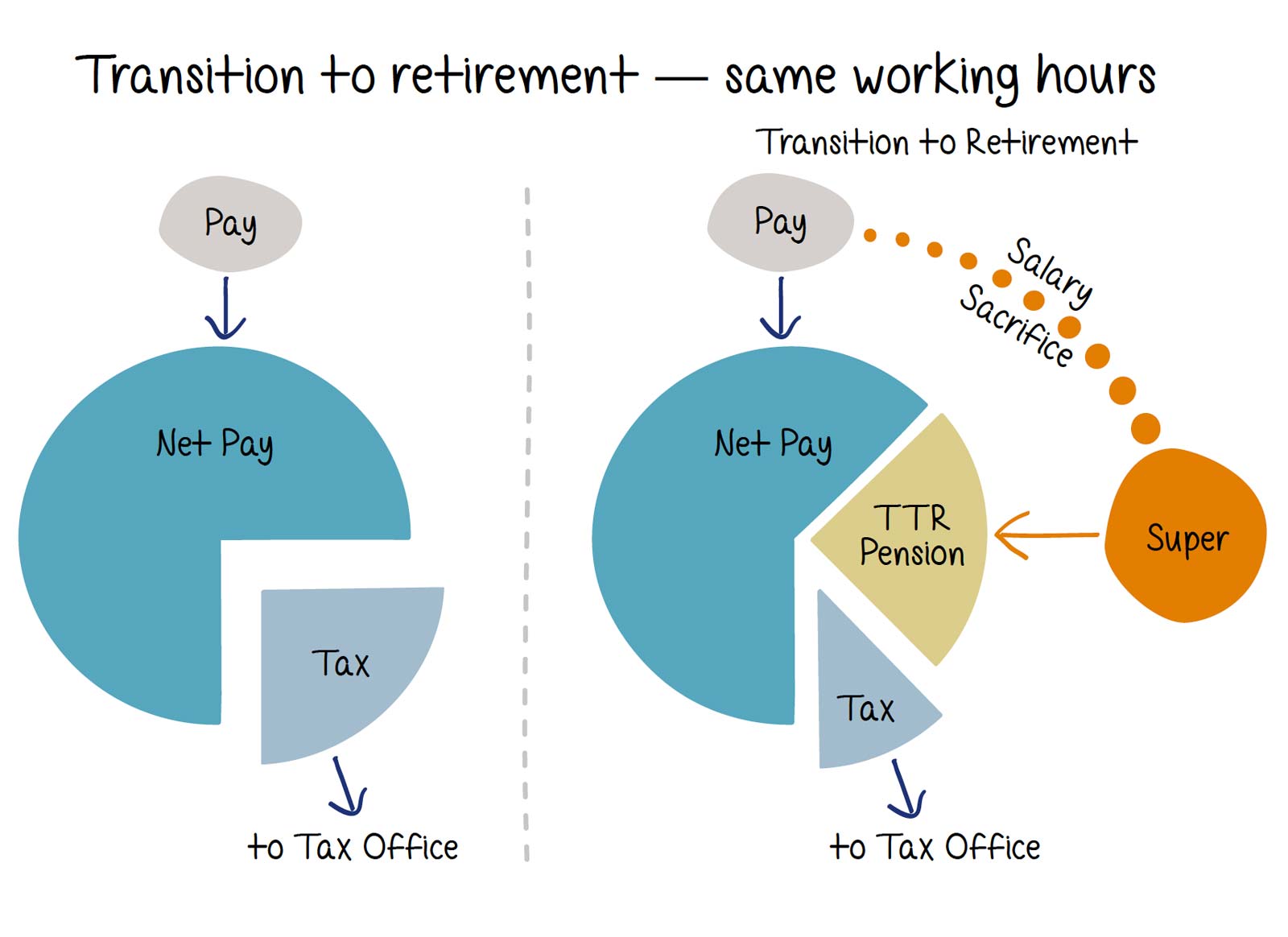

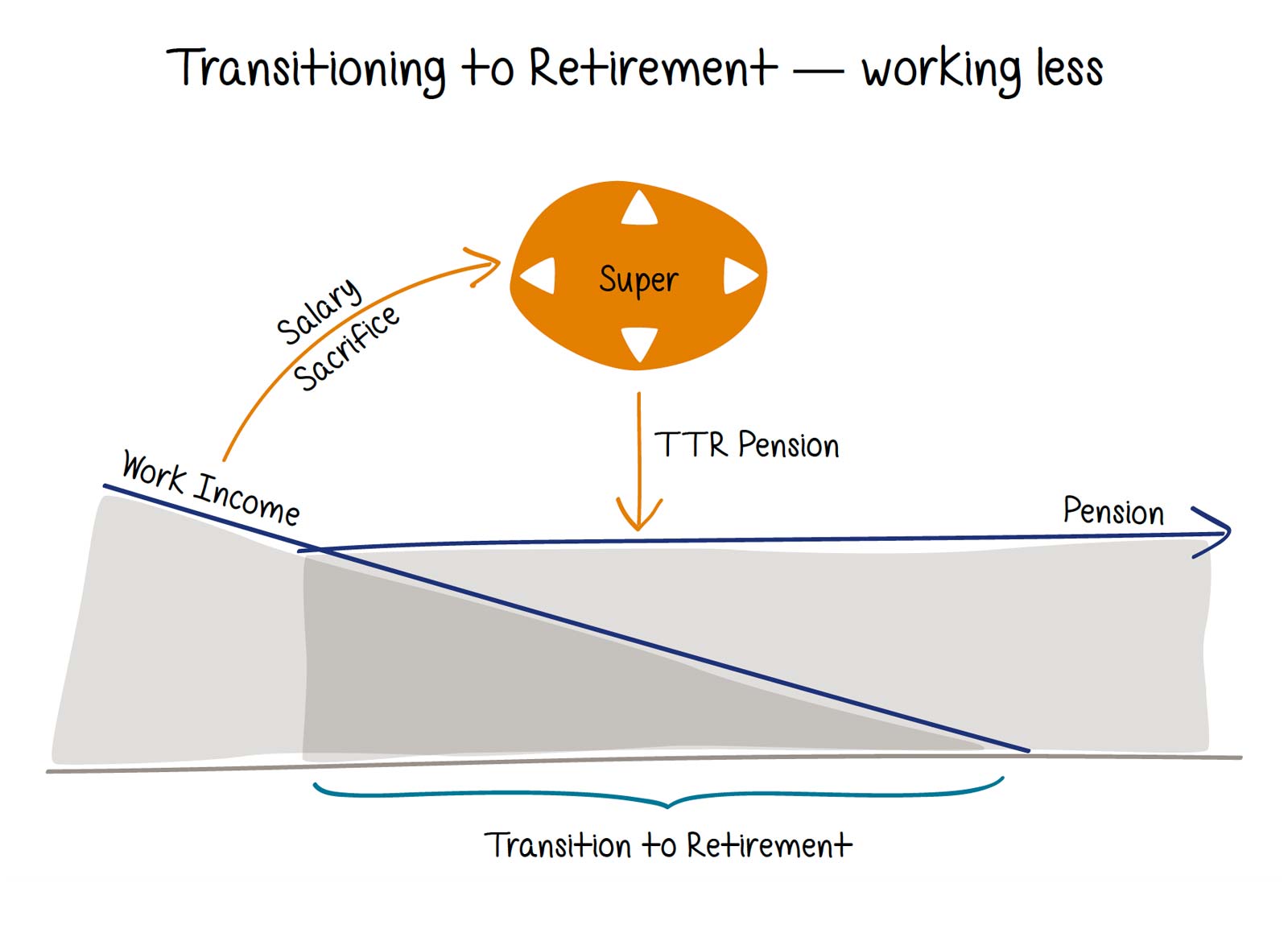

- Transition to retirement

- SMSF investment strategy

For clients who require a wider range of services, through our reliable service partners we can assist you with:

- SMSF establishment or wind-up

- SMSF maintenance

- Home and investment loans

- Business loans and asset finance

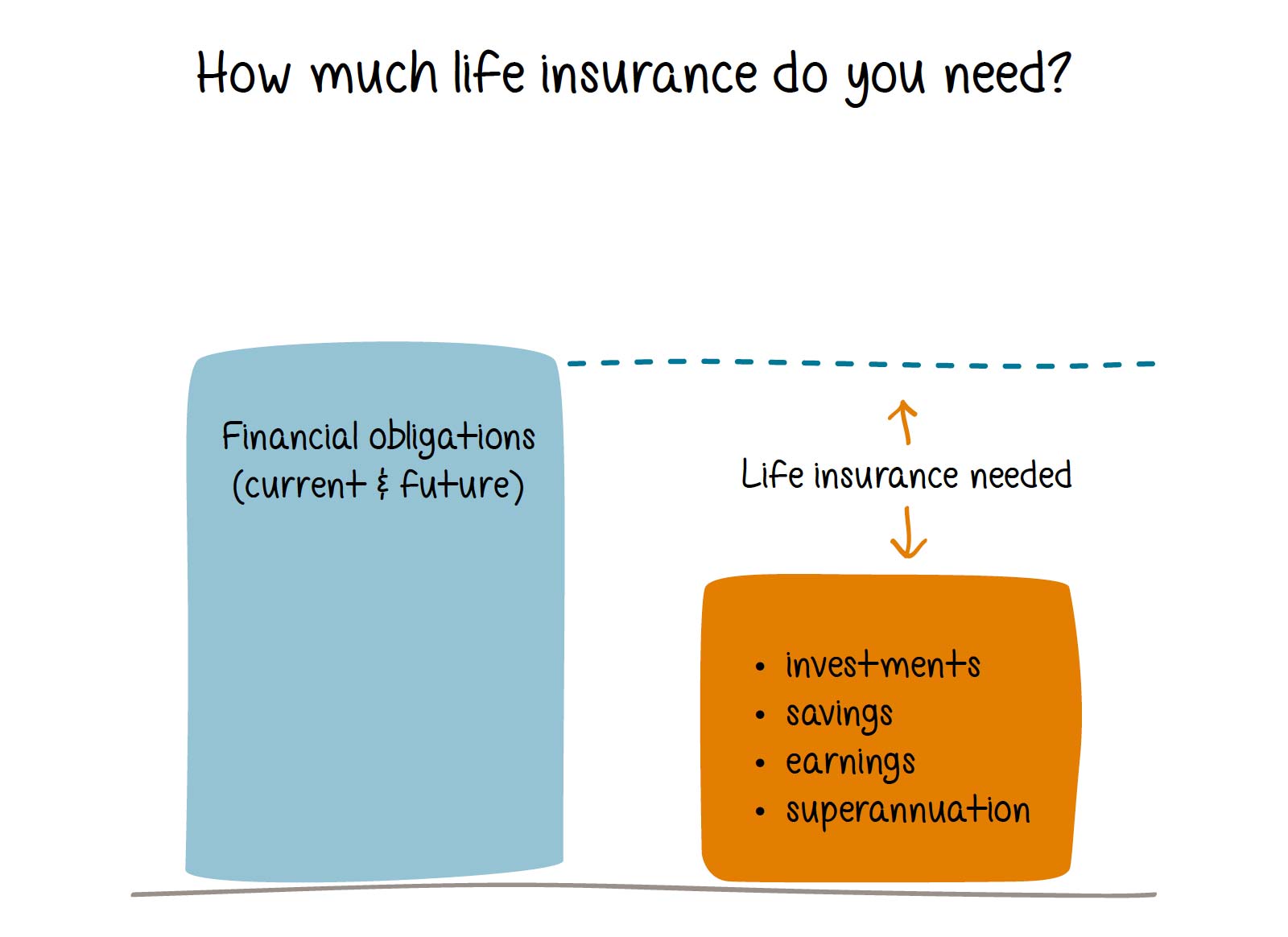

Protecting you and your family

Reassessing your personal insurance to meet your family's changing needs is essential. To ensure your family has adequate cover, the questions you may wish to consider include:

- How would your family cope financially if you experienced a temporary, or permanent and significant, illness or injury that prevented you from working?

- Is your existing insurance cover enough to meet your family's needs?

- Have you reviewed your cover to account for changes in your income and/or debt levels?

- Do your existing insurance policies have clear and unambiguous terms and conditions of when insurance benefits are payable and when they are not?

An affordable, yet well-constructed personal insurance plan can help ensure that you and your family are financially prepared for the unexpected.

Find out more in our Personal Insurance fact sheet

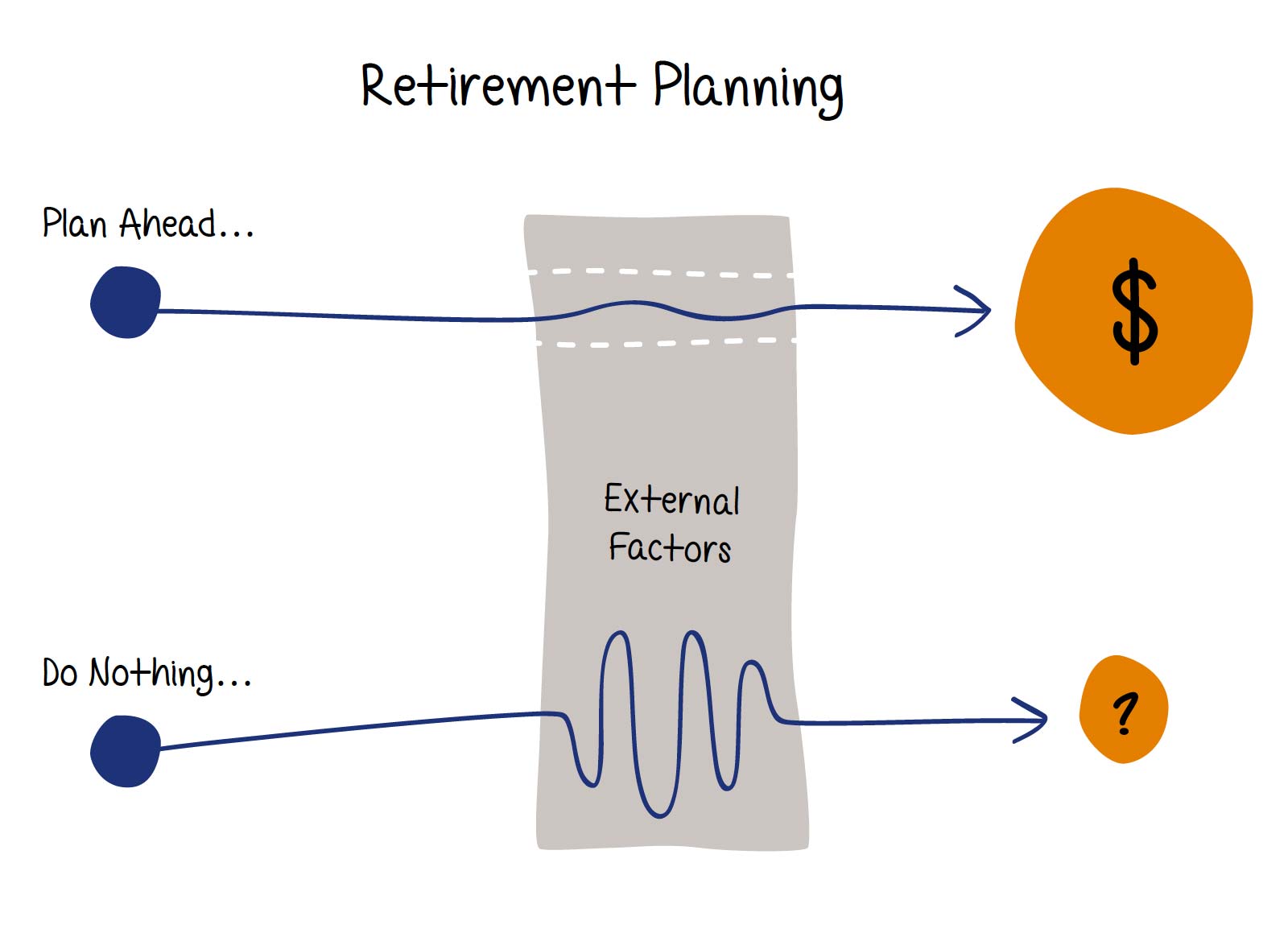

Smart super strategies

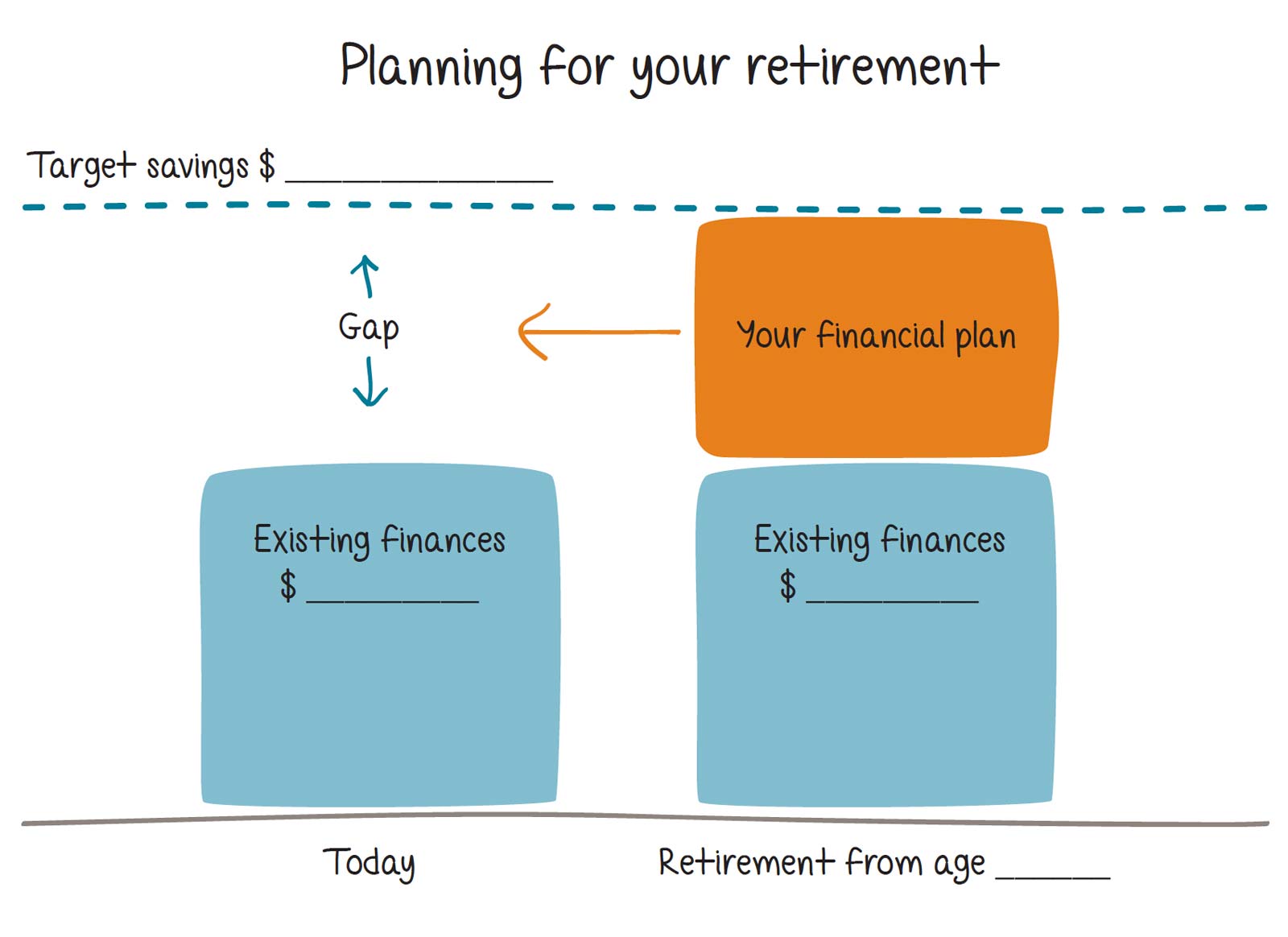

Everyone hopes for a comfortable retirement, but this can mean many things to many people: overseas travel, adding to a property portfolio, ensuring that loved ones are looked after... the possibilities are endless, and one of the key steps to bringing these goals to life is building a tailored financial plan. Another key area to focus on is your superannuation strategy.

Find out more in our Smart Super Strategies fact sheet

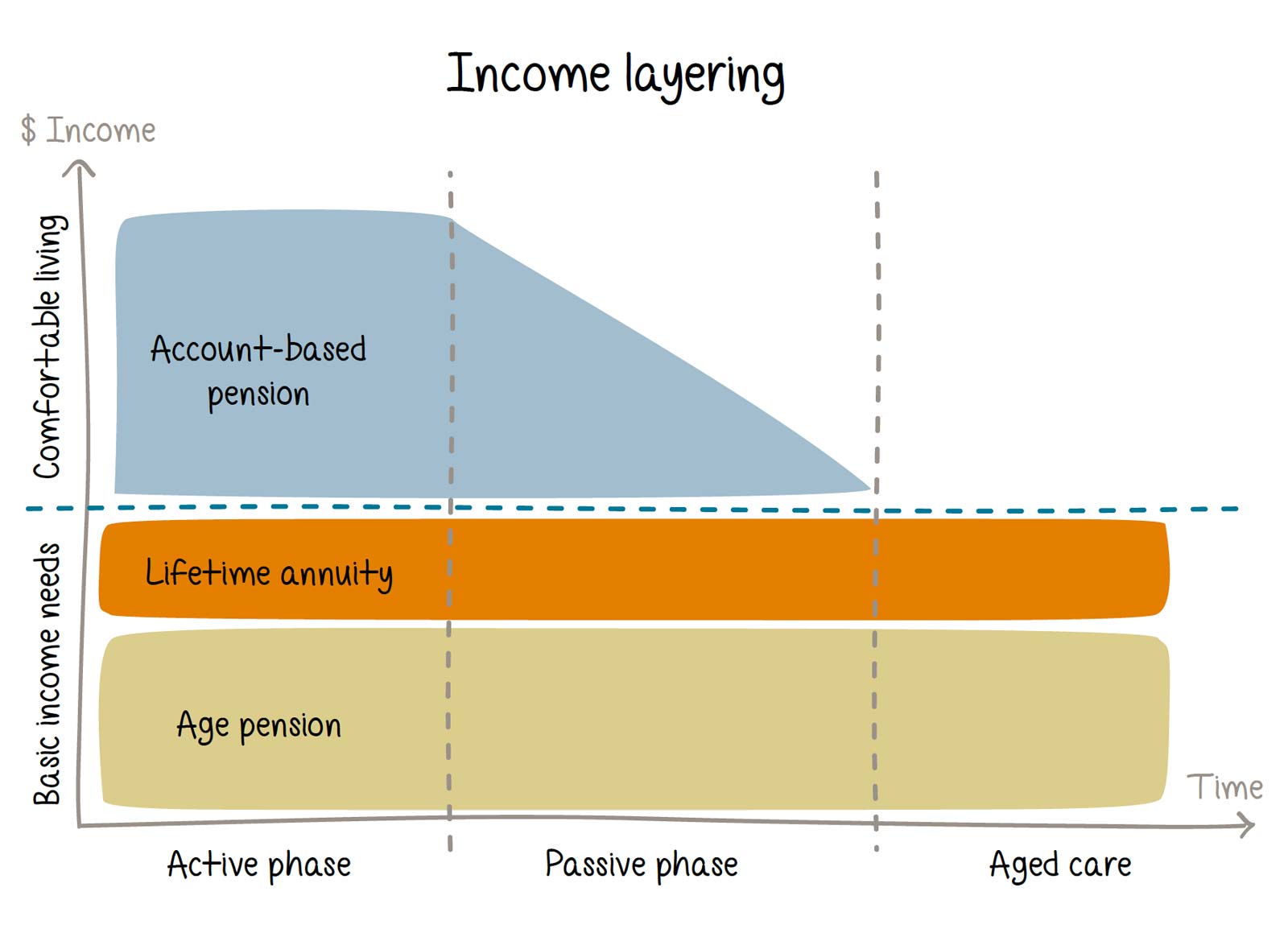

Retirement income streams

One of the most effective ways to provide some or all of your required level of income in retirement may be via a regular retirement income stream such as an account-based pension or an annuity. Some retirees may also be eligible for an Age Pension or other benefits from the Australian Government. It's important to understand how all these options work, to determine the solution that is right for you.

When you meet with us, we'll discuss your objectives, your current situation and answer all of your questions. The financial advice process is all about helping you achieve your goals and feeling comfortable with the strategy and execution, so we make sure the advice we provide is always in your best interests.

We can help you:

- get a clear understanding of your finances and goals to work out how much you need

- understand the choices available to you and set up appropriate strategies to suit your individual circumstances

- create a personalised plan to help you achieve your goals.

We can guide you through the process each step of the way.

Meet & Greet

We, as Count Financial advisers, will spend time with you to review your current situation, understand your goals and attitudes to investing, and outline how you can make the most of your financial future. You can then decide if you want to proceed with more help.

Recommendation

We'll research your options and prepare a personal financial plan tailored to your specific needs, outlining clear strategies that aim to help you reach your goals. We'll answer any questions you have and explain the plan in detail.

Implementation

Once you are completely comfortable and if you agree, we'll implement the best options on your behalf so you can be on the right track to financial security with peace of mind. It's that straight forward.

Review

We'll keep in touch with you and arrange an annual catch up, so we can review your plan and make any adjustments to help keep you on the best path to achieving your goals.

Our Team

-

Dimos Fessopoulos

Director of Financial Planning

-

John Mihail

Financial Planner

-

Yolla Nohra

Lending & Leasing Manager

-

Winnie Su

Paraplanner & Practice Manager

-

Larry Chi

Client Services Coordinator

News & Resources

Financial Planning News

Four SMSF breaches high on the ATO’s radar

The Tax Office is actively targeting SMSF trustees over a range of super breaches. Home ownership is still the great Australian dream for many people.

Home is where the super is for many Australians

More Australians are upsizing their super by downsizing their home.

Investment and economic outlook, February 2025

The latest forecasts for investment returns and region-by-region economic outlook.

TBC increase not just about pensions

An industry consultant has reminded practitioners the indexation measure to be applied to the general transfer balance cap will have implications for other elements of the superannuation system as well that are unrelated to income streams.

SAR non-lodgment continues to be a concern: ATO

The non-lodgment of superannuation annual returns continues to be one of the ATO’s major concerns, the deputy commissioner for superannuation has said.

Tools & Resources

Financial Tools

From drawing up a budget to consolidating your debts to seeing how your retirement funding is looking, our FREE financial tools allow you to do this and much more

Secure File Transfer

Secure File Transfer is a facility that allows the safe and secure exchange of confidential files or documents between you and us

General Calculators

Powered by ASIC's MoneySmart, these FREE calculators can help give you direction and motivate you to achieve your financial goals

Contact Us

Get in Touch

CBC Financial Advisers welcome your enquiry. To book an appointment or simply ask us a question, fill in your details and we'll be in touch soon!

Our Office

- Shop 2, 17-25 William Street, Earlwood NSW 2206

- fp@cbc.com.au

- 1800 622 892

- 1300 307 699

- 9:00AM to 5:30PM

Postal Address

- Reply Paid 135, PO Box 135, Campsie NSW 2194