External partnerships and the in-house asset rules

The introduction of the in-house asset regime for SMSFs saw investment in related companies and trusts slowly disappear from the SMSF landscape. SMSF trustees now looking to use these structures must often jointly invest with others to ensure they comply with the in-house asset provisions set out in Part 8 of the Superannuation Industry (Supervision) Act 1993 (SIS Act). However, navigating the intricacies of the in-house asset rules is not for the faint of heart and requires careful planning and monitoring to ensure the structure does not run afoul of the in-house asset rules. In this article, we examine the rules governing SMSF investments in related entities and how they apply in practice.

When looking directly to the SIS Act:

Section 84 of the act provides that each trustee of a regulated superannuation fund must take all reasonable steps to ensure that the in-house asset provisions are complied with.

An ‘in house asset’ is defined in subsection 71(1) of the SIS Act as:

“An asset of the fund that is a loan to, or an investment in, a related party of the fund, an investment in a related trust of the fund, or an asset of the fund subject to a lease or lease arrangement between a trustee of the fund and a related party of the fund.”

The term ‘related party’ is defined in subsection 10(1) of the SIS Act as any of the following:

- A member of the fund;

- A standard employer sponsor of the fund; or

- A Part 8 associate of an entity referred to in paragraph (a) or (b).

- Subdivision B of the SIS Act defines Part 8 associates for individuals, companies and partnerships. In the case of companies and trusts, a member of a fund and their related parties are Part 8 associates where they:

- Hold sufficient influence over a company, i.e. more than 50 per cent of the directorship of a company;

- Hold more than 50 per cent of the voting rights in a company;

- Are entitled to more than 50 of the capital or income of a trust; or

- Hold sufficient influence over a trust, i.e. more than 50 per cent of the control over the trust. So by having the ownership and control split evenly between each entity the arrangement should not breach the in-house asset provisions.

The area where we tend to see this situation slip up is where the unrelated parties attempt to do additional business together outside of the structure.

Subdivision B of the SIS Act states that partners in a partnership are Part 8 associates of the member/s of the fund. The term ‘partnership’ is defined in the Income Tax Assessment Act 1997 as “an association of persons (other than a company or a limited partnership) carrying on business as partners or in receipt of ordinary income or statutory income jointly”.

This can be an issue since the following scenarios (however, not limited to these) are covered under the definition:

- Opening a joint bank account which derives interest;

- Investing in property such as a rental property that derives rent; or

- Creating a partnership to run a business.

Where the above has occurred, the previously unrelated party is now a Part 8 associate and therefore a related party of the fund per subsection 10(1) of the SIS Act.

Additionally, an in-house asset may occur where the member and their now related party:

- Hold more than 50 per cent of the directorship of a company;

- Hold more than 50 per cent of the voting rights in a company;

- Are entitled to more than 50 of the capital or income of a trust; or

- Hold more than 50 per cent of the control over the trust.

Please note at this stage even though you may have an in-house asset of the fund, there are exceptions under subsection 71(1) of the SIS Act. These include but are not limited to where the investment is in a widely held unit trust or where the underlying asset of the company or unit trust is business real property.

Let’s run through an example based on a company with two SMSFs investing in a service-based business.

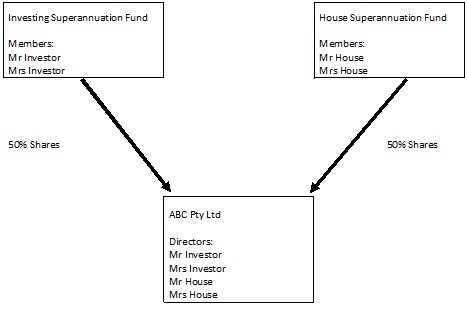

The Investing Superannuation Fund has two members, Mr Investor and Mrs Investor.

House Superannuation Fund has two members, Mr House and Mrs House.

Both funds purchased 10 shares each in ABC Pty Ltd and all four SMSF members are directors of the company.

Looking at this scenario, we can see that no party owns more than 50 per cent of the voting rights nor holds more than 50 per cent of the directorship of the company.

Now let’s add in the fact that the business is doing so well that Mrs Investor and Mrs House decide to purchase a unit and lease it out.

As Mrs Investor and Mrs House are now in receipt of ordinary income by renting out the property they are now in partnership.

From the point of view of Mrs Investor, Mr Investor is a related party as a fellow member of the fund. Additionally, as a partner in a partnership, Mrs House is now a Part 8 associate and therefore a related party.

As related parties, Mrs Investor, Mr Investor and Mrs House now hold 75 per cent of the voting rights and 75 per cent of the directorship of the company. Thus making ABC Pty Ltd a Part 8 associate, under subsection 70B(f) of the SIS Act, and therefore a related party.

Investing Superannuation Fund now has an in-house asset in the form of the investment in ABC Pty Ltd.

This scenario would play out the same way should we look at it from the view point of Mrs House.

Heath Griffiths, director, HG's Super Audits

Columnist: Heath Griffiths

Tuesday 1 September 2015

smsfadviseronline.com.au